I also reviewed official product documentation, watched demo videos, consulted user reviews and cross-referenced software reviews in industry publications. Xero automatically calculates sales tax on companies’ transactions and prepares sales tax returns on the company’s behalf using sales tax reports. Users can set up as many sales tax and the tool will record them automatically. Yes, Xero offers a mobile app, available for both iOS and Android, enabling access to financial data on the go. When selecting an accounting tool, businesses craving depth in financial tracking will find Xero a strong contender.

Xero Accounting Software In-Depth Review 2024

The quote form includes multiple fields, enabling you to provide a thorough description of everything your estimate entails. One limitation is that if you use a custom payment URL, you days sales of inventory dsi will need to manually apply the payment to the invoice once you receive it. Sage 50 Accounting’s Cash Flow Manager tool is a helpful feature for people who want to better understand how future transactions could impact their business.

Contact Management

With a regularly updated appearance, and new features being added all the time even during the coronavirus pandemic, Xero continues to expand its popular appeal and now enjoys a healthy following. how to earn revenue for your nonprofit If you’ve got a business that’s going places, needs dynamic accounting capacity and the ability to add in multiple users then the newest version of Xero requires further investigation. Xero has had even more new features added and, as cloud-based services go, this currently has to be one of the most fully featured options on the market. There is limited tax support, limited invoice templates, no built-in payroll, and a steep learning curve.

This plan is designed for sole proprietors or early-stage enterprises and includes 20 invoices and five bills or purchase orders per month. Users can upgrade at any time to the Growing or Established plans for unlimited bills, purchase orders, and invoices. Has robust reporting tools and report customization options, basic inventory tracking in all plans and a capable mobile app; Early plan limits the number of invoices and bills. However, they were not as comprehensive as what we found in our review of QuickBooks Online.

Customer Support

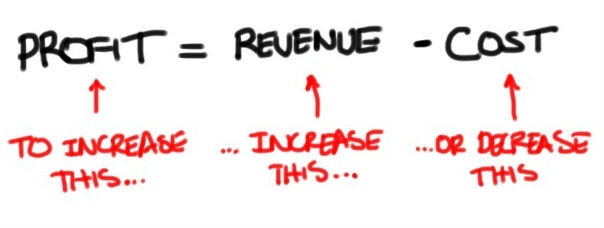

- Xero helps transform the data you enter into actionable information at every subscription level.

- In other words, if you need to do accounting for more than one business, you’ll need to purchase an account for each one.

- Here’s a deep dive into Xero features, best use cases, pricing, customer support, and other purchase factors.

- For more customization and AI-powered predictions, users can switch to Xero Analytics Plus.

- Small businesses can save time and money by automating their accounting processes and consolidating resources for easy access.

- It’s worth noting that some features may require a separate subscription or purchase of add-ons, leading to additional costs beyond the base pricing.

Here, you can produce invoices, bills, purchase orders and more besides, with one-click ease. While the software is well-organized, it does have a steep learning curve (not as steep as QuickBooks, but it is more difficult to learn than other cloud-based options). It takes quite a while to explore all of the features it has to offer, but once you get acquainted with the software, Xero is recourse loans vs non fairly easy to use. Getting started is the most difficult part, and it’s this learning curve that lowered our ease of use rating to 3.8/5.

Expense Management

Additionally, Xero offers a 30-day free trial, so you and your employees can test the software before you buy it. Not every accounting software provider offers a free trial, so we appreciate this feature. Xero lets companies accept payment from their customers using multiple methods, increasing the chance of getting paid on time. It also supports accepting payments directly from the online invoice and reduces the time spent chasing payments. While sending the invoice, companies have the freedom to choose the most suitable payment method for each customer. Xero offers several support channels, including a robust online help center, tutorials, and 24/7 customer support via email.

Xero prioritizes data security with multiple layers of protection, including industry-standard data encryption. The support is heavily weighted to “email” and it can be hard to get people on the phone. If you’re a beginning, Xero has a whole set of videos available to help teach you the software.

All three of these offer the ability to scale their accounting for larger businesses and both Xero and QuickBooks offer specific training for accountants. These companies offer Gusto integration for the same price—$40 per month and $6 per month per person. On the other hand, FreshBooks may be a better fit for freelancers and solopreneurs, as the capabilities are easier to navigate.